When purchasing a home in Spain, several additional taxes and fees must be taken into account. These vary depending on whether the home is brand new or resale. Below, we explain them:

What taxes will I pay if I buy a brand new home?

Purchasing a newly built home in Spain is an attractive option for those looking for a new home with the latest quality and energy efficiency. Purchasing a new home requires the buyer to pay the following taxes:

1) Value Added Tax (VAT):

Value Added Tax (VAT) is levied on the consumption of goods and services at all stages of production and distribution. The tax base is the amount recorded in the purchase order.

-

-

- As a general rule, it is set at 10%

- Except in the case of public housing under a special regime or public promotion, in which case it will be 4%

- However, in the Canary Islands the Canary Islands General Indirect Tax (IGIC) is applied, which is 6.5%

-

2) Tax on Documented Legal Acts (IAJD):

The Tax on Documented Legal Acts (IAJD) taxes acts formalized in public deeds, such as onerous property transfers or corporate transactions. The tax base is the cadastral reference value of the property, determined by the General Directorate of Cadastre.

-

-

- 0,5% → Navarra, Basque Country, Ceuta and Melilla

- 0,75% → Canary Islands, Community of Madrid

- 1% → La Rioja

- 1,2% → Andalucía and Asturias

- 1,5% → Aragón, Cantabria, Castilla y León, Castilla-La Mancha, Catalonia, Valencian Community, Extremadura, Galicia, Balearic Islands and Murcia.

-

What taxes will I pay if I buy a used home?

On the other hand, purchasing a second-hand home in Spain is an attractive option due to its wide range of options, competitive prices, and established locations. These properties are usually located in areas with services, good transport links, and greater urban stability. But what taxes and associated fees will buyers of second-hand homes in Spain face?

1) Property Transfer Tax (ITP):

The Property Transfer Tax (ITP) is levied on the purchase of second-hand homes. The tax base is the cadastral reference value of the property, determined by the General Directorate of Land Registry. This tax is assigned to the Autonomous Communities, and each decides the percentage to apply:

-

-

- Basque Country 4%

- Ceuta 6%

- Community of Madrid 6%

- Melilla 6%

- Navarra 6%

- Canary Islands 6,5%

- Andalucía 7%

- La Rioja 7%

- Aragón 8%

- Asturias 8%

- Balearic Islands 8%

- Castilla y León 8%

- Extremadura 8%

- Murcia 8%

- Cantabria 9%

- Castilla-La Mancha 9%

- Catalonia 10% (**)

- Valencian Community 10%

- Galicia 10%

-

(**) In Catalonia, an increase in the ITP has been introduced in 2025 depending on the purchase amount: under €600,000 (10%), from €600,000 to €900,000 (11%), from €900,000 to €1,500,000 (12%), and above €1,500,000 (13%).

Likewise, and although it depends on each Community, there are discounts when the purchase is for social housing (VPO) or the transaction is carried out by young people or large families and/or with members with some degree of disability.

2) Property Tax (IBI):

The Property Tax is a municipal tax paid annually by homeowners to their local council. The tax base is the property’s cadastral reference value multiplied by a tax rate set by each local council. It is a tax paid for owning and having the right to use:

-

-

- Residential

- Retail

- Garages

- Rural and urban plots of land

-

According to a 2016 Spain’s Supreme Court ruling, the buyer and seller must pay it proportionally, based on the number of days per year each party has owned the home.

What if I decide to buy a plot of land?

Likewise, purchasing land in Spain also entails a series of additional tax expenses. Here’s a summary:

Will I pay ITP or VAT?

The answer to that question is quite simple: it depends on the owner, specifically whether they are an individual (ITP tax shall be paid) or a legal entity (VAT tax shall be paid). Let’s see it:

-

-

-

- When the seller is a company or legal entity, the buyer will pay Value Added Tax (VAT), which is 21% in all of Spain, in addition to the aforementioned Tax on Documented Legal Acts (IAJD), which amounts to approximately 1% of the land value (the exact rate depends on each Autonomous Community). VAT is paid when the deed is signed before a notary.

- Instead, when the seller is a private individual or natural person, the buyer will pay the Property Transfer Tax (ITP), which, as we saw above, also varies depending on each Autonomous Community. The ITP is paid after the sale is formalized, within a period of no more than 30 working days.

-

-

Other expenses associated with the purchase of a home or land

Additionally, the buyer of a home or plot of land in Spain must face the following associated expenses:

-

-

- NOTARY: To certify that the purchase and sale transaction has been completed, it must be documented before a notary. The notary will sign the deed of sale. They will also verify the identity of the buyer and seller, the property’s registration status, the energy certificate, the certificate of zero debt with the community, the certificate of occupancy, and the means of payment. The fees for these professionals are set by the General Council of Notaries. They generally range between 0.2% and 0.5% of the total value.

- PROPERTY REGISTRY: The buyer must go to the Property Registry twice:

-

– To verify who owns the property and whether it is free of encumbrances (this is usually handled by the real estate agency, if there is one)

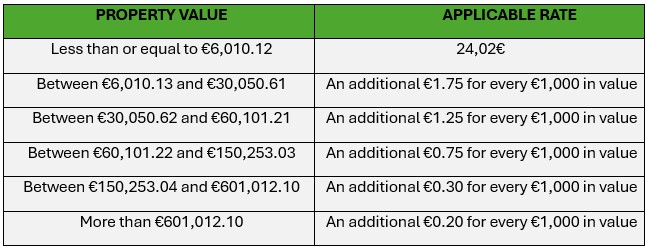

– To register it in the Property Registry. This is highly recommended (although not mandatory), as it is the only way for the buyer to prove their acquired right to the property. Its cost is regulated by the Spanish College of Registrars and will never be less than €24.04 or more than €2,181.67.

The cost will depend on the value of the sale:

-

-

- AGENCY: Although these transactions can be handled in person, it’s very common for a specialized agency to handle all the paperwork, charging approximately €300-€400 (when the home is purchased with a mortgage, the fees are higher). Unlike notaries and registrars, these fees are not regulated. Currently, banks cover the notary fees, the registry fees, and the Tax on Documented Legal Acts (discussed above). This also includes the appraisal fees for the home, which is mandatory when applying for a mortgage, since the property is the bank’s guarantee for the loan. The mortgage origination fee refers to the commission charged by the financial institution and is paid when the loan is granted. There is no limit to this fee, but it can reach up to 2% of the loan value. Finally, there are copies of the deed. The fee is minimal, but the future owner must pay for it out of pocket.

-

Finally, it’s worth adding that the purpose of this article is purely for guidance, and we therefore want to emphasize the importance of being well-informed when embarking on a home purchase and sale transaction and, if possible, enlisting the help of a professional to guide you through the process. Good luck!