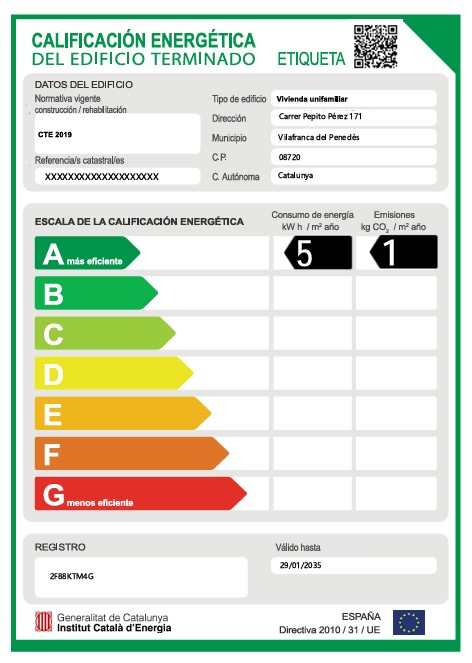

On August 12, new regulations came into force requiring a valid Energy Performance Certificate (EPC) to be issued for a mortgage appraisal. This document indicates how much energy a home consumes under normal conditions and certifies its energy efficiency level, classifying the property on a scale from A to G (from most to least efficient, respectively).

Well, from now on, in order to be able to conduct an appraisal prior to granting a mortgage, the home must have a valid and registered EEC. If the certificate is not available or has expired, the owner must obtain it before the appraiser can issue their report. A maximum of three months has been established for the property’s registration and cadastral certification.

This means that, before signing the deposit for a home, the prospective mortgagee should check whether the property has a valid certificate, otherwise, the transaction could be delayed or blocked.

Finally, a distinction is made between completed buildings and buildings under construction. For buildings under construction or planned, the property’s energy certificate and a copy of the application for registration must be provided. For completed buildings, the duly registered property certificate must be provided.