In one of our previous posts, we discussed the taxes that anyone who buys a home in Spain must pay. Well, today we’ll discuss the taxes that anyone selling a home in Spain must pay.

They are as follows:

PROPERTY TAX (IBI)

The IBI (Impuesto de Bienes Inmuebles = Property Tax) is an annual municipal tax paid by the person listed as the owner of a property as of January 1 of that specific year. It is paid simply for owning a property, and its amount depends on the property’s cadastral value and the tax rate applicable in each municipality.

The law requires the seller and buyer to pay their respective proportional share. That is, if, for example, the purchase of a home is formalized on April 1st, the seller will pay the corresponding portion of the property tax for the first quarter of the year, while the buyer and new owner will pay the corresponding amount for the remainder of the year.

PERSONAL INCOME TAX (IRPF)

The IRPF (Impuesto sobre la Renta de Personas Físicas = Personal Income Tax) is an annual state tax levied on the income earned in a calendar year by every individual resident in Spain. When selling a home, the seller must pay it whenever they have made a capital gain (when they sell their home for a higher price than they paid when they acquired it):

-

- ACQUISITION VALUE: This is the price the seller paid for the home when they acquired it. Other expenses must also be added to this amount, such as:

– Purchase taxes

– Notary fees

– Money invested in substantial home improvement

– The real estate agency commission, if there’s any (mortgage commissions and interests should not be included in the purchase price, but tax benefits for having rented the property should be included)

-

- TRANSMISSION VALUE: This is the price at which the property was sold, minus a series of expenses derived from the sale, such as the agency commission (if applicable), the costs of canceling the mortgage registration, and the taxes themselves.

If the result of the subtraction (Transfer value – Acquisition value) is positive, it will mean that there has been a capital gain, so the seller must pay personal income tax for this transaction in his next income tax return.

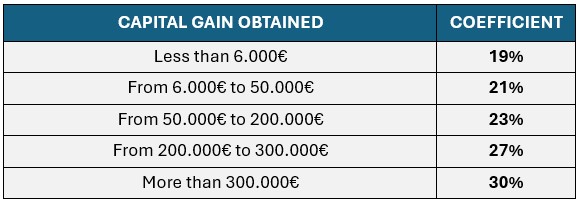

The IRPF percentages for a home sale transaction depend on the capital gain obtained, according to the sections in the following table (2025):

There are some EXEMPTIONS from IRPF:

-

- When there has been no capital gain (although the sale must still be declared)

- When the property sold was a primary residence and all the money from the sale is used to buy another primary residence (i.e., reinvested)

- When the person is over 65 years old and sells their habitual residence, even if they do not buy another home to convert it into their new residence

- When the person is over 65 years old and what they are selling is not their habitual residence but they will invest the money in a life annuity

- When the home is given as a gift to pay a mortgage loan

TAX ON THE INCREASE IN VALUE OF URBAN LAND (IIVTNU)

This tax (Impuesto sobre el Incremento de Valor de los Terrenos de Naturaleza Urbana = Tax on the Increase in Value of Urban Land) is more popularly known in Spain as the «impuesto de plusvalía municipal».

As its name suggests, this is also a municipal tax and refers to the increase in the price of the land on which the property is located during the years the seller has owned it. The seller must pay this tax within 30 working days of the sale.

Capital gains depend on factors such as:

-

- The date of acquisition of the home and the date of sale

- The number of years elapsed between acquisition and transfer

- The revaluation of the land on which the house is built

- The percentage of tax imposed by the City Council

There are some EXEMPTIONS from the capital gains tax:

-

- When the transfer of the home is between spouses

- When the property is considered historical-artistic

- When a dation in payment occurs

- Finally, a 2017 ruling by the Constitutional Court considered that this municipal capital gains tax should not be paid if there was no capital gain.