According to sources of the Business Insider. British fashion magnate Baroness Michelle Monet and her Scottish business partner Doug Barroumen are successfully selling elite real estate in Dubai negotiated with the bitcoin virtual currency.

The Dubai residential complex valued at 267 million euros, developed by Barrowman Aston Developments, a member of the Knox group, was announced last year and must be delivered by 2020.

The complex is located in the Dubai Science Park. The studios are sold individually at a price of $ 130,000 or 15 bitcoins with a room and apartments with two rooms, for $ 380,000 or 45 bitcoins.

“I like that the cryptographic space is used to buy real assets. We allocate 50 of the 1,300 units to be traded with Bitcoins and we have sold them all, “said Doug Barrowman.

The same sources of Bussines Insider had previously reported that several properties in Spain are for sale negotiated with encrypted currency. Among them a house in Can Picafort in Mallorca worth 339,000 euros (can be purchased by bitcoins and ethers), an eighteenth-century palace (Palacio Bardaji) in Ibiza for 1,380 bitcoins and two luxury homes in Barcelona and Madrid from which the value was not informed.

In UNITED STATES, it is not different. Bitcoin is offering foreign investors a loophole to exchange controls in their countries and to economic sanctions in the United States.

According to the real estate agency Redfin, at the end of 2017 bitcoin appeared as a means of payment in some 75 properties in the United States, particularly in Miami South Florida and California.

“Bitcoins are accepted” is a message that begins to appear in the housing description.

In the state of Florida, a commercial agent goes further and only accepts bitcoins (33, specifically) for a half-million-dollar apartment in downtown Miami.

One of the problems that arise when negotiating real estate with Bitcoins is the poor stability of the cryptographic currency that after shooting up to almost $ 20,000 a unit in mid-December and falling precipitously at Christmas, began 2017 around the 14,000 and closed the change today (03/17/2018) to just over $ 7,000. A risk that not everyone is willing to take on.

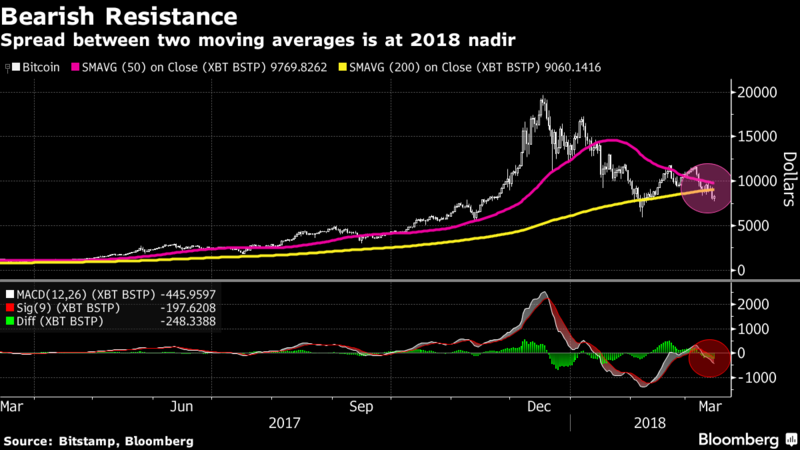

According to the digital economia economiahoy.mx, investors who have assets in bitcoin prepare for a 76% drop. Or at least it is what the technical analysis points to.

The average price of the digital currency of the last 50 days has a devaluation higher than the average recorded in the last 200 days.

How far can Bitcoin fall?

The most pessimistic predict a dramatic end for the Bitcoin and the most critical assure that its real value is zero and that the biggest financial bubble in history has been formed based on unreal expectations that have attracted excessive attention from investors.

The most pessimistic predict a dramatic end for the Bitcoin and the most critical assure that its real value is zero and that the biggest financial bubble in history has been formed based on unreal expectations that have attracted excessive attention from investors.

In spite of the pessimistic omens, it can not be denied that Bitcoin, despite its downward price, has increased its reputation as a real financial asset, and today it allows the nogociation of real estate in many countries.

It has gone from being a marginal phenomenon to making its way into the market.